All About Pensions in Japan

Pensions in Japan can be confusing. Even for long-term residents, it’s hard to be sure who has to contribute, how much you have to pay, when you can receive benefits and how much you can get back if you leave Japan. We’ve prepared a basic pension guide to help you out!

By Michael KanertWhat is Nenkin?

https://www.photo-ac.com/main/search?q=%E5%B9%B4%E9%87%91&qt=&qid=&creator=&ngcreator=&nq=&srt=dlrank&orientation=all&sizesec=all&mdlrlrsec=all&sl=en

Pension in Japan is called nenkin (年金)—literally, “year money.” It’s managed by the Japanese Pension Service (日本年金機構・Nihon Nenkin Kiko), which is run by the Ministry of Health, Labour and Welfare (厚生労働省・Kosei Rodo-sho).

There are two key types of pension plan in Japan: the Employees’ Pension Insurance plan, or kosei nenkin (厚生年金), and the National Pension plan, or kokumin nenkin (国民年金).

Who Must Enroll in Nenkin?

https://www.photo-ac.com/main/search?q=%E5%B9%B4%E9%87%91&qt=&qid=&creator=&ngcreator=&nq=&srt=dlrank&orientation=all&sizesec=all&mdlrlrsec=all&sl=en&pp=70&p=3

Whether you are Japanese or foreign, if you work at least 30 hours a week, you must pay into the Employees’ Pension Insurance plan. The only exceptions are people who are self-employed, or those who work for companies that have fewer than five employees. If you fall into these categories, you must enroll in the National Pension plan.

The National Pension plan is mandatory for all legal residents of Japan—Japanese or foreign, working or not—aged 20 to 59 who do not qualify for the Employees’ Pension Insurance plan. Those eligible to do so may also enroll in both plans.

With either plan, you will get a pension handbook, or nenkin techo (年金手帳), much like a bankbook. It’s important not to lose this, as it will eventually be used to calculate your benefits.

How & When Do You Enroll in Nenkin?

https://www.photo-ac.com/main/search?q=%E5%B9%B4%E9%87%91&qt=&qid=&creator=&ngcreator=&nq=&srt=dlrank&orientation=all&sizesec=all&mdlrlrsec=all&sl=en

If you’re covered by the Employees’ Pension Insurance plan, your employer should enroll you when you start working.

If you stop being covered by the Employees’ Pension Insurance plan, you have to register for the National Pension plan at your local city office within 14 days. If you’re financially independent, you will be classified as a “Category I Insured Person.” If you’re the dependent of someone on the employees’ plan, you should get that person’s employer to register you as a “Category III Insured Person,” but you will still be on the national plan.

How Much Does Nenkin Cost?

https://amanaimages.com/keyword/result.aspx?Page=Search&KeyWord=%94N%8b%e0&ImageID=

For the Employees’ Pension Insurance plan, as of 2018, a rate of 9.15 percent is automatically deducted from your salary monthly. But your company also matches each payment, giving you a total pension contribution of 18.3 percent of your salary. Avoiding this co-payment is one reason why many employers aim to have staff work 29.5 or fewer hours per week. Also note that both you and your employer are exempted from contributions during maternity leave.

For the National Pension plan, from April 2018 to March 2019, the cost is ¥16,340 per month. While it’s mandatory up to age 59 for those not in the employee plan, you can also voluntarily enroll between the ages of 60 and 64. You can also enroll if you were born before April 1, 1965, and have not yet satisfied the 10-year minimum qualification period. With the national plan, you will receive a big, perforated bill in the mail, which you can pay in cash at banks, post offices and convenience stores just like any other bill.

Lump-Sum Nenkin Payment

https://www.photo-ac.com/main/search?q=%E7%A8%8E%E9%87%91&qt=&qid=&creator=&ngcreator=&nq=&srt=dlrank&orientation=all&sizesec=all&mdlrlrsec=all&sl=en&pp=70&p=5

If you’ve yet to receive any pension benefits, you’re not a Japanese citizen and you’ve paid into one of the pension plans for six months or more, when you leave Japan, you can apply to receive a lump-sum payment of your pension contributions—or, if your home country is one of the 18 nations (including the U.S., Canada, Australia, multiple European nations and the Philippines) that has an agreement with Japan, you can have credit for your Japanese pension contributions added to your pension record in your home country.

However, you can only receive back your pension contributions from the last three years at most. The exact amount is calculated based on how long you paid into your plan and what month you ceased to reside in Japan. The currencies available for payment can be seen here.

https://www.photo-ac.com/main/search?q=%E7%A8%8E%E9%87%91&qt=&qid=&creator=&ngcreator=&nq=&srt=dlrank&orientation=all&sizesec=all&mdlrlrsec=all&sl=en&pp=70&p=5

Under the Employees’ Pension Insurance plan, the lump sum is based on your average salary multiplied by anything from 0.5 if you were covered for six to 11 months, up to about 3 if you were covered for three years. Note that your average salary is calculated over all the months you were covered by the plan, not just the last three years, and includes any bonuses you may have received. You can see a detailed table here.

Under the National Pension plan, on the other hand, the lump sum ranges from about ¥50,000 if you were covered from six to 11 months up to about ¥300,000 if you were covered for three years. See the table here for details.

For contributions beyond the last three years and up to 10 years, you cannot get a lump sum, but you can apply to get those contributions applied to the pension plan in your home country.

However, if you live in Japan for 10 years or more, you cannot get any lump-sum payment at all—since you are, in fact, now eligible to receive a Japanese pension (see below). You can either transfer your contribution credit to your home country, or you can wait until you reach at least 60 years of age to begin receiving your pension. And Japanese pensions can be received worldwide!

How to Receive the Lump-Sum Nenkin Payment

https://www.nenkin.go.jp/international/pamphletenglish/index.files/A.pdf

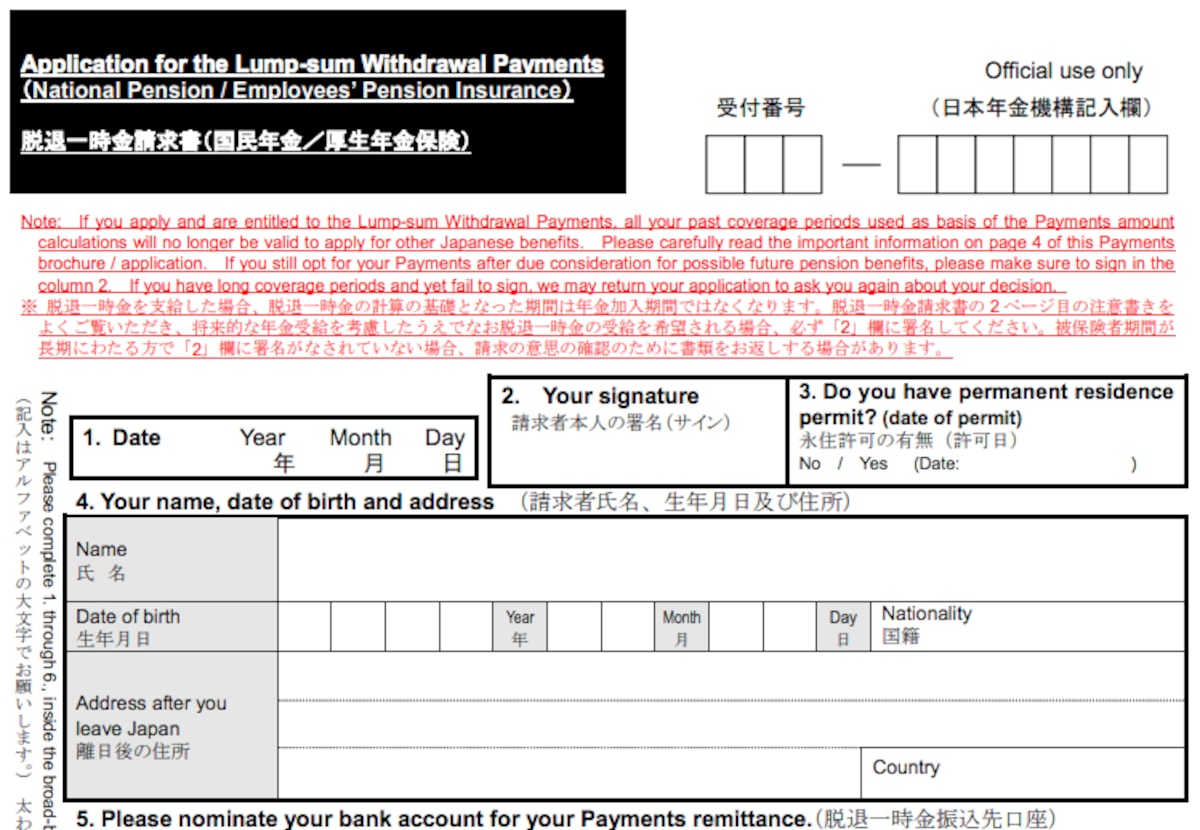

To receive a lump-sum nenkin payment, you need to fill in an Application of the Lump-sum Withdrawal Payments form (脱退一時金請求書・Dattai Ichiji-kin Seikyu-sho) and submit it by post from your home country within two years of leaving Japan. There is an address label attached to the form.

On the form, you will need to write all of your past addresses in Japan, as well as the names and addresses of all your employers, and the dates of your employment periods. If you’ve lived and worked in a lot of places, you might want to confirm all this before leaving Japan—especially if you’re considering throwing out old paperwork before you go!

You will have to include your original pension book along with your submission. You’ll also need a document stamped by your receiving bank that shows its address and branch contact details, as well as your account name and number. You’ll need to include photocopies of the pages of your passport showing the date you left Japan, as well as proof of your residence status while you were in Japan (so don’t throw away your Residence Card!).

https://www.photo-ac.com/main/search?q=%E5%B9%B4%E9%87%91&qt=&qid=&creator=&ngcreator=&nq=&srt=dlrank&orientation=all&sizesec=all&mdlrlrsec=all&sl=en

That all said, if you already have an overseas account ready to receive the money, you can apply in person at your local city office. Just be aware that the money won’t be paid until after you leave Japan. You’ll still need your home bank account details, your pension book and your passport, but rather than a copy of the passport page showing the date you left Japan, you’ll need proof from your city office that you are terminating your residence.

When the lump sum has been paid, you will be sent a Notice of Lump-sum Withdrawal Payments at the address specified on your submission form. This will state both your payment amount and the amount of income tax paid.

That’s right, income tax. The Japanese government will still withhold 20.42 percent of your lump-sum payment for income tax, the standard deduction for income paid overseas.

https://www.nta.go.jp/law/tsutatsu/kobetsu/shotoku/shinkoku/001115/pdf/04/04_007.pdf

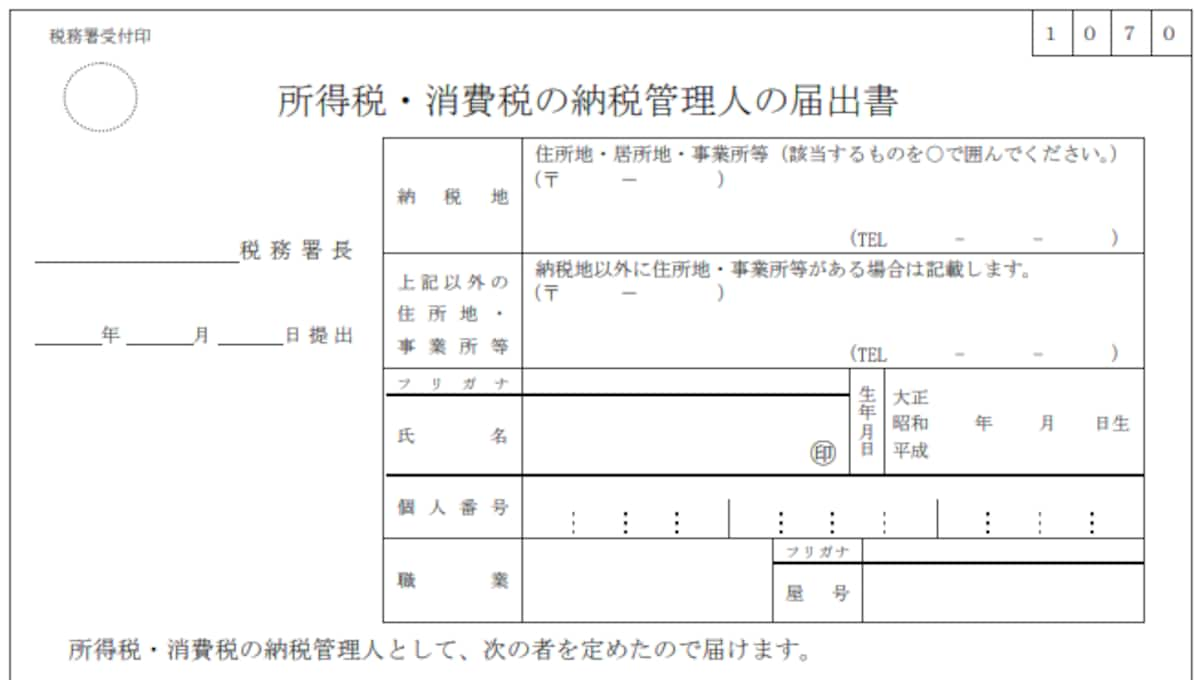

Don’t despair, though: you can get this final amount back as well, but it will require some extra effort and a helpful friend.

You will need to declare someone as your tax representative in Japan. This person must only be a legal resident of Japan at the time your lump sum is received, and they will have to fill out a Declaration Naming a Person to Administer Taxpayer’s Tax Affairs form (納税管理人の届け書・Nozei Kanri-nin no Todoke-sho) at your tax office. While it’s in Japanese, you can find some instructions on how to fill it out here.

Then, you must send your Notice of Lump-sum Withdrawal Payments to your tax representative in Japan, and they can claim the refund for you from the tax office. It’s best if they talk directly with the tax office to confirm precisely how and when to do this.

How to Receive a Japanese Pension

https://www.photo-ac.com/main/search?q=%E5%B9%B4%E9%87%91&qt=&qid=&creator=&ngcreator=&nq=&srt=dlrank&orientation=all&sizesec=all&mdlrlrsec=all&sl=en

If you decide to forego the lump sum and hold out for a Japanese pension, the earliest kick-in age for Employees’ Pension Insurance is currently 60. However, it’s being raised to 65 in stages, and will there by 2025 for men and by 2030 for women. Even now, the amount paid out varies depending on whether you start receiving before or after 65.

The National Pension plan can also be received from 60, but the ideal age is again 65, with penalties for earlier payouts. On the other hand, you can actually increase your benefits by deferring the start of payment up to age 70 (see below).

https://www.nenkin.go.jp/oshirase/topics/2017/20170801.files/101.pdf

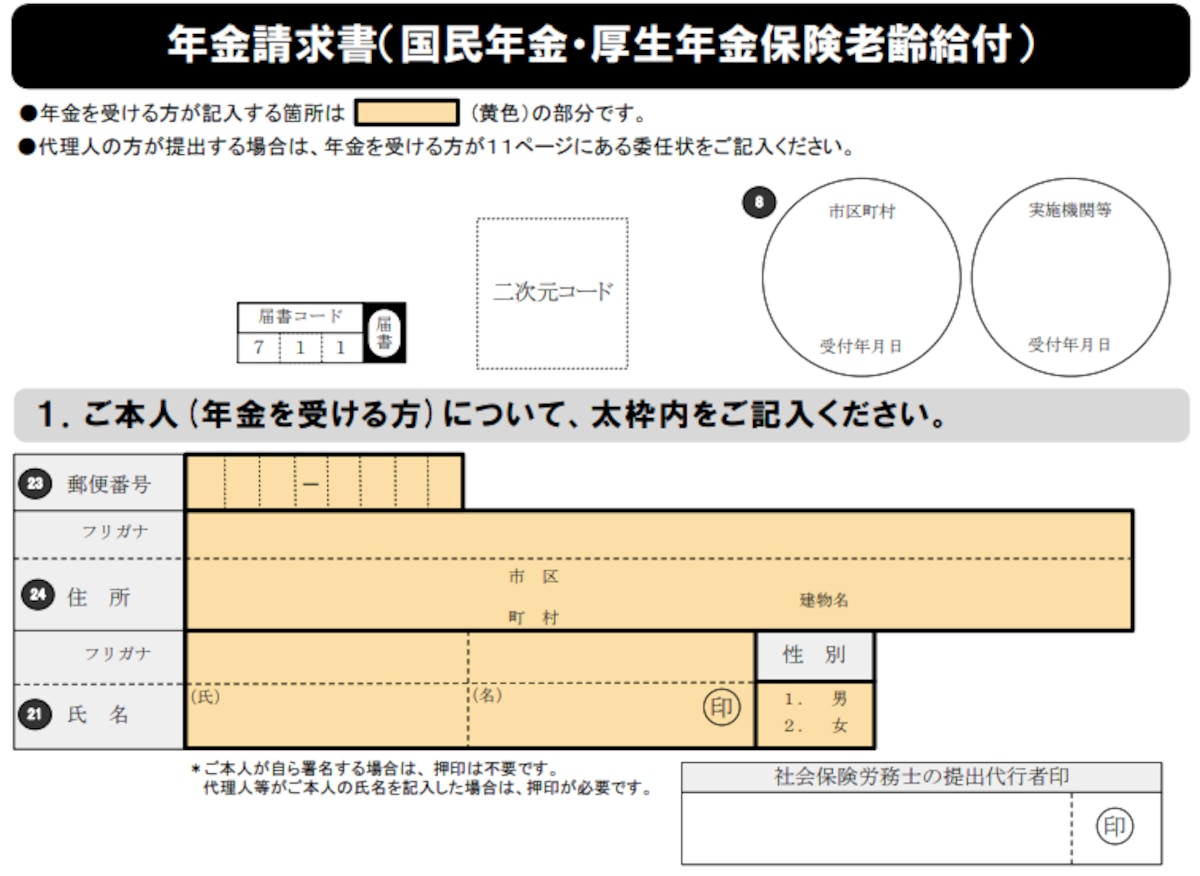

To receive a standard Japanese pension of either kind, you will need an Application for Pension: Old-age Benefits under National Pension/Employees’ Pension Insurance form (年金請求書(国民年金・厚生年金保険老齢給付)・Nenkin Seikyu-sho (Kokumin Nenkin・Kosei Nenkin Hoken Rorei Kyufu)). You can find this at your local pension office (年金事務所・nenkin jimusho). If you don’t live in Japan, you can apply to get a copy of the form shipped to you by applying at a social security office in your home country. You’ll need to attach your pension handbook and a certified copy of your family registry, if applicable.

If you opt for early or delayed payment of your pension, rather than the standard form, fill out the appropriate early or delayed payment forms instead.

You can also claim your benefits early if you are unable to work due to injury or disability, and the funds can be withdrawn by your spouse or children under 18 if you should die.

How Much Does a Japanese Pension Pay?

https://pixta.jp/

If you were enrolled in the Employees’ Pension Insurance plan and paid in throughout your lifetime, you’ll typically receive equivalent to about 50 percent of your average working wage.

That’s a big simplification, however, and you can see the details of the calculation here. The methodology changes depending on whether you start receiving benefits over or under 65, but the key component is based on your average salary multiplied by the number of months you were covered. The multiplier also changes for any salary before 2003.

There are additional benefits for a dependent spouse or dependent children. And your benefits will be reduced or suspended if your total monthly income is more than ¥280,000 while below 65, or more than ¥460,000 at 65 or above.

https://www.photo-ac.com/main/search?q=%E7%A8%8E%E9%87%91&qt=&qid=&creator=&ngcreator=&nq=&srt=dlrank&orientation=all&sizesec=all&mdlrlrsec=all&sl=en&pp=70&p=5

The National Pension plan is much simpler to calculate. As of 2018, if you were enrolled for 40 years, your Old-age Basic Pension amount is a modest ¥779,300 per year. If you did not pay into the system for a full 40 years, the amount will be prorated accordingly.

If you start receiving benefits early, your basic pension amount is reduced by 0.5 percent for each month early you start—so if you start at 60, you will only receive 70 percent of your basic amount. On the other hand, if you wait until you’re 70 or older to start, you can get up to 142 percent of your basic pension amount. And once you start receiving benefits, the amount will not change for the rest of your life.

You don’t have to pay income tax on your pension payments if they are your only source of income in Japan, or if you work fewer than six hours a day and fewer than 20 days in a month.

We hope that answers some of your questions! For more details on the Employees’ Pension insurance plan, click here. For more on the National Pension plan, click here.

*Please note that this article is for information purposes only, and should not replace the advice of an accounting professional or your local pension office.